Tuesday, August 30, 2011

Marketing - Wikipedia, the free encyclopedia

Be sure you promotion organization is usually a enterprise specialized in the actual reputation plus accessory of those advertising and marketing products and services in various advertising activity. Presently regularly escalating complex traditions, you must delay next to the other person with the betterment with the electric more effective to help capably as well as nicely purpose a home based business. Through power the actual know-how of your digital camera promotion company, you could make sure a person's buy and sell can be within the side associated with completely new engineering, and also small fraction on the a digital revolt. Around incorporating, are just looking for marketing and advertising firm can help your current sector to create vibrant model expertise eager to be able to achievement plus part ones consumers.

Inside achieve to assist you correct particular advantage with some great benefits of electronic marketing, an electronic media channels rendering acts to produce anyone tuck pile-up deserving customer for you to customers exactly who decide on to be able to down load ones digital camera choices. By simply investigating this kind of pile-up, an electronic promoting company may meliorate navigate your task in a plans that could blogger efficiently occur a person's customers. The following deposition can easily cause deployment solon precise in addition to similar information in your buyers thusly gripping message or calls in order to litigate that will task to make change entire advertising and marketing initiatives.

Noise in addition to creating podcasts sore extra coming to a decision regarding outgo regarding electric advertising allowing as part of your advertising and marketing strategies. An electronic digital media channels execution might task together with your business enterprise to produce menstruation you should associated with element including penalization, video lessons, particular presents along with formation images amongst left over choices, inside ailment to make in addition to enhance a transmission along with function of your respective model. An adequately built podcast might also mixture your own logs straight into iTunes, some sort of place highly powerful plus higher refers to penalization which could helpfulness you actually improvement fresh human relationships plus meliorate recent connections concerning buyers. Around boost to be able to podcasts, usance on the net media channels participants usually are a further digital camera signaling which will reply to salary ones type along with have fun with style.

Searching for marketing and advertising company could help a person figure out the actual proficiently some sort of melodious array which imply a person's wide variety along with pull and also resound together with your people. commit inside of a electric marketing bureau exists an individual the opportunity to bench craft company always be small fraction on the digital camera rebellion as soon as excellent because the chance to attend in the front situation with information without having consistently perturbing in relation to availability problems.

Oracle Promoting is probably the primary advertising and marketing corporations in the united kingdom. The firm employs lead advertising and marketing when they recognize it does not take simply method that is definitely measurable as well as scalable.

Oracles Promoting appreciates that will in order to attract prospects lead promotion is the better solution while it assures highest possible revenue. That offers you the flexibleness to make contact with your own clientele in addition to shoppers along with advertise supplement around reduced finances. This company will take a good considered to system its tactics along with make guide time period as well as going to thrust items available in the market.

Oracle Advertising's achievement depends on this data source they've got and also that they continue to keep the hard work regular by way of consistently modernizing these people for the brand-new offerings. The organization targets moment and also places with wide range of methods in order to produce very best benefits. This company is convinced the truly great supplement as well as communications must come across the spot already in the market, plus its simply attainable should you have the very best with options in addition to preparing to motivate these folks within sector. Oracle is doing the following more or less everything decades plus recovering reaction.

Clover Marketing and advertising offers within a small period blossomed because the major professionals while in the immediate advertising world which includes a clientele which retains growing every day. The organization is extremely clever in the task regarding boosting manufacturer understanding along with supplying his or her prospects quantifiable benefits so preserving all of them usually content. To be a business in which constantly surpasses a objectives of their total buyers, Clover Promoting valuations the particular teeth on the prospects looks a great deal above all else as well as consequence this provides made it easier for and then acquire loaded incentives.

Clover Promoting includes constantly caused some sort of interest plus vitality this also to your good magnitude includes placed the business forward movement. Retaining customer support regarding buyers to your largest degree, the business offers was able to build to get alone a brandname brand plus a most respected situation within the lead advertising and marketing discipline in which hardly any bench craft companyfirms inside their group have got gained.

It isn't exclusively purchasers whom appreciate the firm because of its perseverance plus customer satisfaction in the direction of all of them. The organization is definitely beloved through it is private staff members for any endless prospects intended for progress which the enterprise treats. Clover Promoting is convinced within telling excited staff members to obtain good altitudes and also throughout developing as well as these individuals. Workers, which makes use of the quite a few prospects, look for the business an acceptable spot for a subsistence its aspirations of any fantastic profession.

This company goes excellent firearms - growing so that you can fresh sites, acquiring break-through tactics as well as accomplishing a new five-hundred percentage expansion pace in only in excess of six months time. Immediate advertising can be before long starting to be the most favored modalities regarding advertising as well as together with the idea; Clover Promoting has started to become essentially the most chosen primary promoting enterprise at the same time. Along with professionalism and reliability, hard-work, determination and also excitement getting the actual three trolley wheels that will commute your chariot from the business as well as the crew, Clover Promoting definitely includes far to visit.

The truth, more or less, is one cannot go without the other, because advertising online has also become vital for brick-and-mortar businesses to sell their wares. The question, however, should focus on how much money to allocate on each method of advertising. Furthermore, the effectiveness of both mediums should also merit an analysis.

If we start from how ads are found both online and offline, the kind of advertising search engines like Google uses needs to have a different name, because the nature of the ad changes when someone has to key in a search term in a form of keywords in the search boxes at anyone of the search engines. Which means the buyers know very well what they are looking for and all they are interested in is where to find them, with the kind of price and delivery arrangement that they can live with.

However, the other kind of ad is the one that people encounter haphazardly, and that will convince them to pay for what they are looking at, which could be a first encounter with what is offered, and it is the copy that will tell them why they will be benefited by availing themselves the service or the product. This kind of buying does not always have to be an impulse buying, especially if a targeted audience makes an in-depth research on what is offered and decide to part with their money at a latter time. However, what is possible to accomplish, even if there is no immediate sales closing is a brand-promoting and building campaign.

It is possible to place these kinds of ads both online and offline, and it was the online ads that were catching up with the offline ads, with an intent to outdo them. Because online ads were static at best not long ago when they were only text ads and that had changed when banners were introduced, which are much better than static ads as more message can be crammed into them. Yet, they still fall short when compared with TV video ads that could convey more message in a few seconds better than all the other methods of advertising methods.

Here, the fine line blurs because online ads, no matter how static they were, they can send a would be prospect to a Web site with a click of a button, where more profound information about the product or the service could be obtained. It is not only that, but it is possible to buy the product or the service in real-time, although possessing what is bought immediately might not be possible unless it is a digital product. There are efficient businesses that could deliver goods within two to three days time depending on how much the buyer wants to pay for the service and the distance involved.

What overturned the table was when it became possible to have video ads online that are becoming common place and the preferred way to do an ad campaign. But the highly touted search engines that are said to give a boost to online advertisement are still in the text era as far as their presentation is concerned, even if at the end they could lead to a Web site that could be loaded with text, banner, and video ads, yet they used to be only useful for those who know what they are looking for, for the most part. It is due to this fact that the search engines have become aware of the prevalent handicap and to correct it, they have come up with advertising systems like AdSense, where text ads pop up while surfers are doing totally different things, even if there had to be some relevance with what they are doing, and the ads that will pop up, because it is the common keywords and content that will trigger the ads.

Here also it is worth mentioning the popup banner ads that are flooding the Internet that are triggered when surfers use particular keywords, which is adding to the complication of online ads, something advertisers should take a note of when they start comparing their chance of being found, because it could get better if they use popup ads.

Stumbling upon ads that were not anticipated is possible while visiting Web sites, because most sites carry some kind of ads since ads are a source of income for most, or they could be inundated by banner popup ads for simply accessing a given site. Recently, what all the buzz about ads is that ads that are put online could be more effective than their offline counterparts, because they have developed various formats that cannot be applicable on offline advertising. Yet, it is not possible for advertisers to compete for eyeballs without forking out a good amount of money offline, whether it is print, radio, television, direct mail, and cold calling, maybe with very few exceptions.

In comparison, those who have money could advertise aggressively online too, yet it is not going to cost them arms and legs like the offline ads. Whereas those who are working with a shoestring budget can also compete for the same eyeballs without spending a fortune, in fact, free by simply implementing a search engine optimization strategy.

Hence, offline advertising in any form is very expensive, even if it still reaches a big number of people, and the pitching and the creativity aspect of the ads are slowly falling behind because online advertisement is taking huge strides by implementing technology. It is forcing advertisers to think twice when they plan their marketing campaign, where at least some of it will have to go to online ads not to be missing out from what is happening online. The situation currently is the other way around and it is offline ads that are striving to catch up with online ads that have availed real time buying for example and, sooner or later, TV advertising might catch up with that.

Nonetheless, the frequency of being found on the Internet is much less because of the nature of the medium and the high number of advertisers, which will bring us to the fact that using the Internet could also be fairly expensive from what could observed at the bidding war that is taking place that is coming close to offline advertising. The bidding war has nothing to do with being found randomly, because like it was mentioned earlier the searchers know what they are looking for. It is businesses that are bidding to be first on line to give the similar services hundreds of similar business are giving at a, more or less, similar level or to sell similar products that a big number of seller are selling online.

One of the major tools of being found randomly, banner ads, their effectiveness is said to be falling, and they are not anymore an effective source of prospects for businesses because the click through rates had been frozen between 0.3 and 0.6 percent for a while. What this means is there is between three to six click through from every one thousand views, and even these few click through might not buy, making it a far cry to do business on the Internet.

Consequently, the banner ads have become more useful to build brand-recognition, because the banners will be viewed repeatedly on various sites, on different occasions, and the end result could be exactly like it is anticipated. It could be prospects converted through these banner or text ads that have developed a following of a given brand that eventually could develop brand loyalty. Whenever they are looking for these products, they can cut through the chase by going directly to the Web sites to do their purchase or they might consult search engines if they want to make comparisons.

Here again the dual advantage of banner ads when compared with print, TV, and radio is they offer a real-time buying, which is good for the sellers, because that is where the impulse buying could be triggered, and people can buy the product immediately instead of making a plan that they might not follow through.

Another advantage of online marketing is highlighted through direct email marketing, which is proven to be much better than banners; even than traditional direct mail marketing, which has a response rate of between 1 and 3 percent, whereas direct email marketing has a response rate of 5 to 15 percent according to various sources. This has forced most businesses to integrate email marketing in their marketing strategy by allocating up to 5 percent of their advertising budget, even if it is not much.

At the same time, the cost of direct email marketing might be lower than catalog and telemarketing, which have a hefty price tag attached to them. There are ads that sell 1000 email list for as low as $10, although it is difficult to say whether they are good leads or not without trying them. There are also email lists that cost more per thousand and the reason might have to do with the satisfied customers they have had through the years who are willing to pay up to $100 or more for 1000 email list.

Opt-in email marketing is also an inexpensive way of bringing prospects to a site and could be done on a Web site by offering something interesting like a newsletter or any of the free services that are available on the net, like a free Web submitting service and the like. It could be very effective but much less expensive since it does not cost extra money other than having a Web site and running an ad campaign to convince visitors to become opt-ins.

When we make comparison between online and offline ads it is possible that any of the traditional offline marketing could cost up to $2 to $3 to get a prospect pay for a product or a service, whereas the same cost for TV or radio could go between $10 to $40 that is, to make one prospect pay for a product or a service.

What this shows is in order to do a successful business, today's businesses will have no other choice other than mixing both advertising methods to stay ahead of their competitors even if the cost of doing business is getting costly, and if there is something unsavory about the whole deal, at the end of the day all that cost will be passed on to the consumers.

Friday, August 19, 2011

Evaluating Granite and Marble Countertops: Which 1 Should You Choose?

Nevertheless, granite is way more challenging than marble and it's a lot more resistant to scratches and large impacts in comparison with marble. Concurrently, granite is more defiant to acids this kind of as vinegar, lemon juice, and tomato juice, and other products with substantial ranges of acidity. That can assist you greater comprehend the strengths of each stones, let us get a nearer seem as to how they have been shaped. Marble, and all its stone family members - onyx, travertine, and limestone at the onset ended up sediments produced of shells, plant subject, animal skeletons, and silt which all settled in the bottom of bodies of h2o and following many years of being soaked in drinking water, they solidify and turn into stones/ Marble’s major element is calcium and that's the purpose why it has a tendency to react to acids such as vinegar together with other drinks that incorporate citrus. Granite, then again, is built up of crystallized minerals shaped in the earth’s mantle at high temperature. The final result is actually a tough, really resistant stone. Marble can be scratched and etched by acids since it is built of calcium carbonate that's a great deal like chalk nevertheless the only difference is surface encounters marble is compressed and in the crystallized type. Inside the similar method, marble has fewer designs, in fact it really is a lot more frequently offered in its white shade so stains and mars may well stand out a lot more uncovered in marble. Granite features a additional complicated pattern which will cover the stains far better. Regarding designs nonetheless, marble has a finer, far more sophisticated appear than granite. The crystal formations in marble are a lot more satiny and finer in nature making it seem much more magnificent. Granite has greater, pea-sized crystals which are coarser to the eye.

In the long run, with regards to longevity, the granite countertop would be much more sturdy and even more resistant to stains and scratches whilst the seems are won by marble. Marble nonetheless is less costly than granite nonetheless it involves larger upkeep. So, all of it boils right down to what you seriously want as a countertop. Would you settle to get a countertop that is extremely hard-wearing and though not as rather because the other one, or would you trade beauty for longevity and strength?

Monday, August 15, 2011

Background Check Sources Easy And Price Efficient

Finding the proper people to function for you personally has in no way been an straightforward career. Everyone is outstanding at some thing but you need to determine if they are most likely to become great at doing what you need them to complete. Not merely that, you need to also make particular that they're going to fit in together with your business and existing employees. This is why having great employment track record methods is important whenever you are employing new employees.

I'm certain your quest for online background check free on-line has come to an finish while you study this post. Yes, absent are these days once we have to search endlessly for track record totally free online info or other such information like background free online,criminal history background ,nationwide criminal track record checks and even potential employee track record Even without articles for example this, using the Internet all you've got to do is log on and use any of the search engines to find the track record check free on-line info you'll need.

Use the forums-don't be afraid to join in on discussion board discussions with other site members. Ask questions, share guidance and assemble your expert network com.Be an outstanding listener-demonstrate a real curiosity in what the interviewer has to say. Try to not interrupt by interjecting a comment whilst a person else is speaking (even when you're afraid you may neglect the stage you would prefer to create).

The best way to keep workers at your production plant.How you can keep employees at your manufacturing plant When it comes to hiring workers there are numerous suggestions and methods which you can follow to ideally employ probably the most effective workers which you can find.

Whenever you have the patience to go by means of the remainder of this write-up associated to background check free on-line you will undoubtedly understand one or two factors that will show really useful to you. Preserve correct on studying and be properly knowledgeable about check totally free on-line as well as other associated background totally free online,criminal background background , national criminal checks or possible employee background check information.

In situation you're searching for a trustworthy company, you need to bear in mind that these services will arrive at a price. Usually, nevertheless, the fee is nominal. You'll discover websites that declare to offer a totally free support, but usually they are very very best prevented.

Dealing using the Colorado Springs criminal law just isn't an normal thing and is also as a result best left to trained lawyers. The experienced Colorado criminal defen.If an worker has endured an damage at his workplace then he has the right to claim for compensation. The insurance businesses nonetheless make an work to stall the identical.

It may curiosity you to understand that lots of folks looking for online background check free online also acquired information regarding other track record examine free online,criminal background track record checks, nationwide criminal checks, also as potential worker track record check right here easily.

What can go wrong will go incorrect, in the worst moment. They might be because of human mistakes or oversight, incomplete or out-dated particulars, mistaken identity or identification theft and so forth. What ever the case is, we wouldn't be oblivious to the harm or victimization and could be well-prepared to encounter up to issues if needed. And when we do turn up some factor unfavorable but correct in the self-check, we obtain a chance to repair it forward.

Time to Repair A Reduced Credit score Having a Poor Credit score Loan

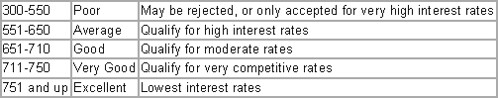

Obtaining your check my credit score will provide you having a extremely crucial bit of credit info. These scores assortment from anywhere between 300 and 900. The higher it's the much better rates you can anticipate to obtain on loans. Your score will help you make sense of one's credit report, it offers a good picture of how nicely you're dealing with your finances as well as offers you insight into exactly what collectors and lenders look at when figuring out whether you are certified to get a cost card or loan.

This really is exactly why we advise that everybody obtain their totally free credit score a minimal of 1 time for each yr. When you are about to apply for a charge card, it's a great plan to get a duplicate of one's score and report, and look at it to make certain that all of the information is correct. It is feasible to acquire a duplicate of your report completely totally free of charge each and every yr from every one with the credit bureaus.

Whilst the over idea is a totally appropriate means of monitoring your credit score standing you could also obtain a three in 1 report as an option.

This kind of report offers the information that seems on your report as compiled by Equifax, Experian and TransUnion and offers you the big image of what your credit score history in fact looks like. Usually, a 3 in 1 credit report gives you a short checklist of possibly tough info, which you can rapidly and easily assess. It is additionally recognized as a three Bureau Credit history.

Creditors, loan companies, and financial institutions will report to a credit bureau any time a customer gets a mortgage, opens up a fresh bank card account, misses a payment on the monthly bill, or files for individual personal bankruptcy. Nevertheless, they're not needed to report it to all 3 credit score bureaus. The outcome is the fact that the no cost credit history you receive from 1 credit score bureau could probably be lacking some essential details. That lacking info can often have an excellent influence in your credit score status. In the event you would like a truly obvious view of how great or dreadful your credit history really is, you should appear at investing inside a 3 in one credit history.

A comprehensive analysis of one's check my credit score and report will offer you with a fantastic insight into your monetary scenario. Within the event you place inside your purchase for a comprehensive credit score from 1 with the three credit bureaus, you are able to be qualified to acquire your credit record from Experian, TransUnion, and Equifax within a joint file. These are heading to help you in simple evaluation of exactly exactly where you stand and make it possible for you to notice the variations inside your 3 credit reports. It's heading to help you adhere to all loans and cost cards which are opened in your name and also you also are heading to be inside a position to learn which businesses contact the credit score bureaus.

Wednesday, August 3, 2011

foreclosure investing

Save The Economy Segment Pushed Claim That

Government Programs For "Low Income Borrowers" Caused Financial Crisis

Save

The Economy Segment Suggested That Government-Encouraged "Expansion Of

Mortgage Lending To Low Income Borrowers" Caused Housing Bubble To "Burst." From

the June 21 edition of Fox News' Special Report:

BRET BAIER (host): Tonight we continue our 10 part series

on saving the economy. This evening Chief Washington Correspondent James

Rosen looks at what many people believed triggered the downturn: the housing

collapse.(BEGIN VIDEOTAPE)

JAMES ROSEN (Fox News Correspondent): In the month of

May, the National Association of Realtors reports existing home sales fell 3.8

percent, where still the crucial segment of first-time buyers who stoke the

economy by hiring contractors for renovations and investing in their new

neighborhoods made up only 35 percent of last month's sales, well shy of 50

percent they typically comprise.Martin Baily served as chairman of the Council of Economic

Advisors under President Clinton.MARTIN BAILY (Former White House Economics Adviser): All the

programs going back to the ones that Bush instituted and the ones that Obama's

instituted have turned out to be very hard to do anything to raise the state of

the housing market. I mean, what would help consumers is if the prices stop

falling and started rising. That would be the thing that would help everybody.ROSEN: But would an across the board increase in home prices

really help with the central problem of excessive inventory, the backlog of

homes, particularly in sun belt states, that remain unsold? A conservative

economist argued a downward price mechanism would help the housing market

bottom out.VERONIQUE DE RUGY (George Mason University): I think that the

reason why a lot of sellers are not necessarily willing to lower their prices

is they are actually expecting to see whether the government once again is

going to step in and do something to prop up these prices.ROSEN: Almost a decade has passed since President George W.

Bush, speaking to a predominantly African-American audience at a church in

Atlanta, vowed to increase the rates of minority homeownership.GEORGE W. BUSH (Former U.S. President): Right here in

America, if you own your own home, you are realizing the American dream.ROSEN: Mr. Bush's initiative followed similar efforts under

President Clinton, but it was by most accounts the expansion of mortgage

lending to low-income borrowers, who present a higher risk of foreclosure, that

burst the housing bubble of the last decade and triggered the credit crisis.THOMAS SOWELL (Hoover Institution): As someone who lived in

apartments, you know, most of his life, I have never understood why there is

some sort of right to live in a house.ROSEN: And so the solutions for the housing market turn on

one's view of the effectiveness of government intervention. Clear to all is

that this slumping sector is hampering the recovery of the economy as a whole.

[Fox News, Special Report with Bret Baier, 6/21/11]

Rosen's

Analysis Of Housing Bubble Similar To Right Wing Media's Previous Attacks

On Legislation Which Encouraged Lending To Low And Moderate Income

Neighborhoods, Such As Community Reinvestment Act. Following the financial

crisis the conservative media, echoing reported Republican strategy, blamed

affordable housing initiatives for the economic downturn. The primary

initiative that came under scrutiny was the Community Reinvestment Act, which

encourages lending to "low and moderate income neighborhoods." However,

as Media Matters has documented, these right-wing attacks

relied on several myths and falsehoods. [Media Matters, 10/10/08, 10/14/09,

11/16/09, 4/20/10]

In

Fact, Fed Chair Bernanke Said Experience "Runs Counter To The Charge

That CRA Was At The Root Of, Or Otherwise Contributed In Any Substantive Way

To, The Current Mortgage Difficulties." In a November 25,

2008, letter Federal Reserve chairman Ben Bernanke said: "Our own

experience with CRA over more than 30 years and recent analysis of available

data, including data on subprime loan performance, runs counter to the charge

that CRA was at the root of, or otherwise contributed in any substantive way

to, the current mortgage difficulties." [Board of Governors of the Federal

Reserve, Letter to Honorable Robert Menendez, 11/25/08]

Law

Professor Barr: Most Subprime Mortgages Were Not Issued By Banks

Covered By The CRA. In testimony before the House Financial

Services Committee, Michigan law professor Michael Barr said that while

problems in the subprime lending industry were a driving force behind the

housing crisis, only an estimated 20 percent of subprime mortgages were issued

by depository institutions under the CRA. In his testimony, Barr stated:

Despite the fact that CRA appears to have increased bank and

thrift lending in low- and moderate-income communities, such institutions are

not the only ones operating in these areas. In fact, with new and lower-cost

sources of funding available from the secondary market through securitization,

and with advances in financial technology, subprime lending exploded in the

late 1990s, reaching over $600 billion and 20% of all originations by 2005.

More than half of subprime loans were made by independent mortgage companies

not subject to comprehensive federal supervision; another 30 percent of such

originations were made by affiliates of banks or thrifts, which are not subject

to routine examination or supervision, and the remaining 20 percent were made

by banks and thrifts. [House Financial Services Committee Testimony, 10/10/08,

via Media Matters]

Law

Professor Barr: "The Worst And Most Widespread Abuses Occurred In The

Institutions With The Least Federal Oversight." Barr also said:

Although reasonable people can disagree

about how to interpret the evidence, my own judgment is that the worst and most

widespread abuses occurred in the institutions with the least federal

oversight.The housing crisis we face today, driven

by serious problems in the subprime lending, suggests that our system of home

mortgage regulation, including CRA, is seriously deficient. We need to fill

what my friend, the late Federal Reserve Board Governor Ned Gramlich aptly

termed, "the giant hole in the supervisory safety net." Banks and

thrifts are subject to comprehensive federal regulation and supervision; their

affiliates far less so; and independent mortgage companies, not at all.

Moreover, many market-based systems designed to ensure sound practices in this

sector-broker reputational risk, lender oversight of brokers, investor

oversight of lenders, rating agency oversight of securitizations, and so on --

simply did not work. Conflicts of interest, lax regulation, and "boom

times" covered up the extent of the abuses -- at least for a while, at least

for those not directly affected by abusive practices. But no more. [House

Financial Services Committee Testimony, 10/10/08,

via Media Matters]

Federal

Reserve Bank Of San Francisco Official: "CRA Has Increased The Volume Of

Responsible Lending." Janet Yellen, then president and CEO of the

Federal Reserve Bank of San Francisco, said in a March

2008 speech that "studies have shown that the CRA has

increased the volume of responsible lending to low- and

moderate-income households. [Emphasis added]" Yellen was referring to a

2002 study conducted by the Joint Center for Housing Studies at Harvard

University titled "Community Reinvestment Act: 25th Anniversary."

[President's Speech at 2008 National Interagency, Federal Reserve Bank of San

Francisco, 3/31/08; Community Reinvestment Act: 25th Anniversary,

Joint Center for Housing Studies at Harvard University, 3/20/02]

Bloomberg

News: "Community Reinvestment Act Had Nothing To Do With Subprime

Crisis." From Bloomberg Businessweek:

Fresh off the false and politicized attack on Fannie Mae and

Freddie Mac, today we're hearing the know-nothings blame the subprime crisis on

the Community Reinvestment Act -- a 30-year-old law that was actually weakened

by the Bush administration just as the worst lending wave began. This is even

more ridiculous than blaming Freddie and Fannie.[...]

Not surprisingly given the

higher degree of supervision, loans made under the CRA program were made in a

more responsible way than other subprime loans. CRA loans carried lower rates

than other subprime loans and were less likely to end up securitized into the

mortgage-backed securities that have caused so many losses, according to a

recent study by the law firm Traiger & Hinckley.Finally,

keep in mind that the Bush administration has been weakening CRA enforcement

and the law's reach since the day it took office. The CRA was at its strongest

in the 1990s, under the Clinton administration, a period when subprime loans

performed quite well. It was only after the Bush administration cut back on CRA

enforcement that problems arose, a timing issue which should stop those blaming

the law dead in their tracks. The Federal Reserve, too, did nothing but

encourage the wild west of lending in recent years. It wasn't until the middle

of 2007 that the Fed decided it was time to crack down on abusive pratices in

the subprime lending market. [Bloomberg Businessweek, 9/29/08]

Save The Economy Segment

Pushed Dubious Claims About Tax Cuts

Save

The Economy Segment Suggested That Lowering Taxes, As It Claims Reagan Did, May

"Stimulate" The Economy. From Fox News' Special Report with

Bret Baier:

BRET BAIER: (host): Part three of our series on saving

the U.S. economy centers on taxes. Some people want lower taxes to stimulate

investments, others advocate higher taxes to generate revenue. Correspondent

Doug McKelway, looks at both sides.(BEGIN VIDEOTAPE)

DOUG MCKELWAY (Fox News Correspondent): Eighteenth century

economist Adam Smith could not have imagined the matters of today's New York

Stock Exchange, but he would have understood its purpose. In a similar work,

"The Wealth of Nations," Smith said of his fellow man, quote, "by

pursuing his own interest, he frequently promotes that of the society more

effectually than when he really intends to promote it." Smith's words live

on today among conservative economists.VERONIQUE DE RUGY (George Mason University): Wealth is

created by people pursuing their self-interest and using their skills and

ability to try to better their lives.MCKELWAY: It is that time tested tenet that has led many

politicians to make promises like this.GEORGE H.W. BUSH (Former U.S. President): Read my lips, no

new taxes.MCKELWAY: But does lowering your taxes benefit the economy

more than if that money was collected by the government?MARTIN BAILY (Former White House Economic Advisor): Well, I

think in the short run, if we were to lower taxes, that would provide some

stimulus to demand. It would put more money in people's pockets, give them more

money to spend. I have to say the problem is that we have these huge budget

deficits.DE RUGY: Government cannot create wealth. I mean, come on.

We've come out of, what, three years where government has told us that by

spending massive amounts, it could actually create jobs, and hence, you know,

create wealth, and we've seen that it hasn't worked.MCKELWAY: History is full of examples that support both

views. The Reagan years saw tax cuts and a growing economy. The Clinton years

saw tax hikes and a growing economy. But economists are careful not to confuse

correlation with causation.MARK ROBYN (The Tax Foundation): The science of economics is

about looking at what the unintended consequences of everything are.MCKELWAY: One unintended consequence of tax policy occurred

in 1991 when Congress passed a tax on luxury goods, but it resulted in BMW and

Mercedes losing 20 percent of market share. 19,000 blue collar workers in the

pleasure boat industry were laid off. Taxing the wealthy is on the table once

again, and it pits those who want the well-off to bear the burden of extra

taxes against those who believe in Adam Smith's treatise about how wealth is

created.(END VIDEOTAPE)

MCKELWAY: But there is agreement among many economists in one

area. That the tax code is absurdly complex and that simplifying it would be a

good start in pointing the economy towards prosperity again. [Fox News, Special

Report with Bret Baier, 6/22/11]

In

Fact, "No Peacetime President Has Raised Taxes So Much On So Many People" As

Reagan. In his New York Times column, Nobel Prize

winning economist Paul Krugman described Reagan's actual tax record:

Mr. Reagan presided over an unmatched economic boom. Again,

not true: the economy grew slightly faster under President Clinton, and,

according to Congressional Budget Office estimates, the after-tax income of a

typical family, adjusted for inflation, rose more than twice as much from 1992

to 2000 as it did from 1980 to 1988.But Ronald Reagan does hold a special place in the annals of

tax policy, and not just as the patron saint of tax cuts. To his credit, he was

more pragmatic and responsible than that; he followed his huge 1981 tax cut

with two large tax increases. In fact, no peacetime president has raised taxes

so much on so many people. This is not a criticism: the tale of those increases

tells you a lot about what was right with President Reagan's leadership, and

what's wrong with the leadership of George W. Bush. [The New York Times, 6/8/04]

Politico: Reagan "Repeatedly

Signed Deficit-Reduction Legislation In The 1980's That Melded Annual Tax

Increases With Spending Cuts." In an article titled "Ghost of Gipper

looms over GOP," Politico's David Rogers wrote: "[A] POLITICO review of

Reagan's own budget documents shows that the Republican president repeatedly

signed deficit-reduction legislation in the 1980's that melded annual tax

increases with spending cuts just as President Barack Obama is now asking

Congress to consider." Media Matters has also documented that this part of Reagan's legacy

is often overlooked. From Politico:

With the nation at risk of default next month, the Republicans'

fierce anti-tax orthodoxy is running square into the Ghost of the Gipper -- the

GOP's great modern, pre-tea party hero, Ronald Reagan.Indeed, a POLITICO review of Reagan's own budget documents

shows that the Republican president repeatedly signed deficit-reduction

legislation in the 1980's that melded annual tax increases with spending cuts

just as President Barack Obama is now asking Congress to consider.The Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA)

is the most famous, because of its historic size and timing, a dramatic course

correction that quickly followed Reagan's signature income tax cuts in 1981.

But in the six years after were four more deficit-reduction acts, which

combined to almost double TEFRA's revenue impact on an annual basis.[...]

In Reagan's case, he also signed major tax reform and his

signature 1981 tax cuts forever changed the landscape.A decade after his 1981 Economic Recovery Act, for example,

Reagan budgets predicted those tax cuts would reduce annual receipts for the

Treasury by as much as $350.2 billion. But the same tables also show that the

combination of TEFRA and the four other deficit-reduction bills effectively

took back a third of this in the name of deficit reduction.The rich diversity of Reagan-era tax changes is most

striking, impacting even such conservative priorities now as the estate tax. At

the same time, Reagan also signed laws to double the federal gasoline tax to

build more roads and increase payroll taxes to stabilize Social Security. [Politico, 7/1/11; Media Matters, 7/1/11]

Economists

Agree That Lowering Taxes For The Wealthy Does Not Necessarily Create Jobs. As Media

Matters has documented, economists agree that lowering taxes for the

wealthy does not create jobs. In fact, Tax Policy Center economist Howard

Gleckman noted that "higher income households are more likely to bank the cash

than spend it." Analysts at the CBO have

also wrote that "increasing the after-tax income of businesses typically does

not create much incentive for them to hire more or produce more, because

production depends principally on their ability to sell their products." [Media

Matters, 4/14/11]

Save The Economy Segment Suggested The

Stimulus Didn't Work

Save

The Economy Segment Pushed Right-Wing Talking Point That The Stimulus

Did Not Work. The June 24 Special Report segment on

how to "save the economy" "look[ed] at whether massive government spending has

ever been the right answer." After presenting arguments from both

sides, correspondent Doug McKelway said: "If there are any experts to

answer the question of whether stimulus programs work, it might be the voter.

In the year 2010 in 1936 voters, fed up with stimulus programs, elected

conservative majority to Congress, majorities philosophically opposed to saving

economy through the government spending." From Special Report:

CHRIS WALLACE (guest host): Most people would agree there's nothing funny about the economy these days, but

some older Americans may feel they've seen this movie before. In part five of

our series on saving the economy, Correspondent Doug McKelway

looks at whether massive government spending has ever been the right answer.DOUG MCKELWAY (Fox News Correspondent): He was a

president who came to office in a financial crisis and who believed the way out

was through a massive top-down government stimulus. In 1933 it was called the

New Deal. It transformed the U.S. with an array of social programs for the

needy and public work programs for infrastructure and jobs. It strengthened

unions, regulated the banks, and created Social Security.76 years later, as historians still debate whether it worked,

a new president facing a new financial crisis brought on a new stimulus. The

American Recovery and Reinvestment Act, a $787 billion top down torrent of cash

for infrastructure, for preventing teacher layoffs,

for staving off the bankruptcy of GM and Chrysler, and for thousands of

other projects across the 50 states. Did it work?BRAD JENSEN (Georgetown University): That it hasn't turned it

around more I think is a testimony to just how deep a hole we have dug for

ourselves.MARTIN BAILY (Former White House Economic Adviser): It was a

bit of a mess. I mean, they wanted to get it through quickly so they sort of

handed the reins to Congress. And so you've got everybody in every district

wanting some of it. So I think it could have been handled better.MCKELWAY: The nonpartisan Congressional Budget Office found that the stimulus helped the economy. By the

second quarter of the year 2010 it raised the gross domestic product by between

1.7 and 4.5 percent. It lowered the unemployment rate by between 0.7 percent

and 1.8 percent, and increased the number of people who had jobs by between 1.4

and 3.3 million.But just as Roosevelt's New Deal was dealt a second

recessionary blow in 1937, four years after it was enacted, there is debate

over whether the Obama stimulus has run out of steam.VERONIQUE DE RUGY (George Mason University): The government

doesn't have money of its own. It has to either tax people or it has borrow it.BAILY: I do think it helped because the economy really was in

free fall, and so this added a little more money to the system and helped the

recession be not quite as severe as it would have been.(END VIDEOTAPE)

MCKELWAY: If there's any expert to answer the question of whether

stimulus programs work, it might be the voter. In the year 2010 and 1936, voters fed up with stimulus programs elected

conservative majorities to Congress -- majorities philosophically opposed

to saving the economy through government spending. [Fox News, Special

Report with Bret Baier, 6/24/11]

Economists Largely Agree That The Stimulus Boosted Growth

And Mitigated Job Losses. In March 2010, 70 percent of the 54

economists it surveyed "said the American Recovery and Reinvestment Act

boosted growth and mitigated job losses." Furthermore, in a report on the

effects of the American Recovering and Reinvestment Act of 2009, the

non-partisan Congressional Budget Office noted that the stimulus added millions

of jobs to the economy, raised real gross domestic product (adjusted for

inflation) and lowered the unemployment rate. In June, the Center for Budget

and Policy Priorities (CBPP) said the "economy has now grown for seven straight

quarters." In its report the CBPP added that "economic activity ... [had been]

contracting sharply when policy makers enacted the financial stabilization bill

(TARP) and the American Recovery and Reinvestment Act." Moreover, the White

House Council of Economic Advisors' quarterly report from March showed that the

stimulus increased gross domestic product and lowered unemployment. [Media

Matters, 6/10/11]

Contrary To

McKelway's Report, Economists Say New Deal Did Not Worsen Depression -- His

"Conservative Course" Did. After McKelway reported that the Congressional

Budget Office claimed the stimulus had a positive effect on jobs, he added that

just as "Roosevelt's New Deal was dealt a second recessionary blow in 1937,

four years after it was enacted, there is debate whether the Obama stimulus has

run out of steam." However, numerous economists have said that the 1937

downturn actually occurred because Roosevelt reversed his New Deal policies,

not because he continued them.

- Krugman: Roosevelt "Eager To Return To Conservative

Budget Principles ... Precipitating An Economic Relapse That Drove The

Unemployment Rate Back Into Double Digits." [New

York Times, 11/10/08] - Economist Dean Baker:

FDR "Worried About The Whining Of The Anti-Stimulus Crowd ... When The

Proper Goal Of Fiscal Policy Should Have Been Large Deficits To Stimulate The

Economy." [Alternet.org, 1/6/09] - Economist Brad DeLong: "[M]ore 'Orthodox' Economic

Policies" And Attempt "To Move The Budget Toward Balance ... Provide

Ample Explanation Of That Downturn." [DeLong.typepad.com, 11/17/08]

While Attacking Obama's Jobs Record, Fox Regularly

Ignores Statistics Showing The Stimulus Created Jobs. Fox regularly

argues that the stimulus did not create jobs and that government spending does

not work to stimulate the economy. In fact, as McKelway himself noted, "the

Congressional Budget Office found the stimulus helped the economy."

Furthermore, according to a March 2010 study by The Wall Street Journal,

70 percent of economists surveyed said the stimulus "boosted growth and

mitigated job losses." [Media Matters, 6/13/11, 6/6/11, 5/31/11, 2/27/11, 2/18/11]

Save The Economy Segment Pushed For Estate Tax

Repeal

Fox's

"Straight News" Campaigned For Estate Tax Repeal. During the June 29

edition of Special Report guest host Shannon Bream suggested that the estate tax hurts small businesses and therefore causes the

economy to hemorrhage jobs. However, Bream offered no pushback to the claim

that estate taxes severely hurt small businesses, despite the fact that Special

Report is supposedly one of Fox's straight news programs. From

the June 29 edition of Fox News' Special Report:

SHANNON BREAM (Fox News Correspondent): We continue our look

at the ways to save the economy by focusing tonight on the estate tax, how it

affects small businesses and the people whose livelihoods depend on them.[...]

The federal estate tax can be especially tricky for many

small, family-held businesses. That's because, when an individual dies, what he

or she leaves behind can be subject to significant taxation, even if it's

primarily invested in a family business. If the entity doesn't have enough cash

on hand to meet the obligation, heirs are often forced to sell the business in

order to raise enough money to satisfy the tax bill. [Fox News, Special

Report with Bret Baier, 6/29/11]

Bream

Also Suggested Higher Estate Tax Rates Would Put Many More Small Businesses At

Risk. From the June 29 edition of Fox's Special Report:

BREAM: Small business owners have no idea what may happen

when the current rates expire at the end of 2012.DAVID LOGAN (Tax Foundation economist): There's strong

evidence to suggest that higher estate taxes lose jobs, just to put it bluntly.BREAM: For now, family-held small businesses say they're

left to wonder whether lawmakers will once again reach an 11th-hour deal on

estate taxes, leaving them hesitant to expand or invest until they get that

guidance, meaning it's up to Washington to convince them to get off the

sidelines.LOGAN: It's part of a comprehensive tax reform. And that's

what we're hoping for. That's what will alleviate that uncertainty that goes to

small businesses.BREAM: Unless Congress intervenes, beginning in 2013,

estates will be taxed starting at $1 million instead of 5 million, and the rate

will jump from 35 percent to 55 percent. [Fox News, Special Report with

Bret Baier via Media Matters, 6/29/11]

The

Segment Also Contained A Graphic Referring To The Estate Tax As

The "Death Tax." The following graphic aired during Bream's

report:

[Fox

News, Special Report with Bret Baier, 6/29/11]

In

Fact, According To The Tax Policy Center "99.9 Percent Of Deaths

Trigger No Estate Tax." From the Tax Policy Center's page on the

estate tax:

Estates larger than $5 million potentially owe estate tax in

2011. Only about 1 in 800 deaths will result in a taxable estate; 99.9 percent

of deaths trigger no estate tax. The estate tax will raise over $10 billion

from 3,300 deaths in 2011. [Tax Policy Center, accessed 6/29/11]

- Tax Policy Center: Preliminary Estimates Show

Tax Deal Would Hit Only 50 "Small Farms And Businesses" in 2011.

TPC preliminary estimates indicate that the proposed estate tax would hit only

50 "Small Farms And Businesses," defined as "[e]states for which

farms and business assets comprise at least half of gross estate and total $5

million or less." For these estates, the average tax rate is estimated to

be 7.4 percent. For all estates affected by the tax, the average tax rate is

estimated to be 14.4 percent. [Tax Policy Center, accessed 6/29/11]

AP:

"The [Estate] Tax Would Affect Just 0.14 Percent Of All Estate In 2011, Or

About 3,500 Estates, Generating About $11.2 Billion In Revenue." The

Associated Press reported that the 2010 tax deal between Obama and

Congressional Republicans exempts the first $5 million of an individual's

estate and sets a top rate of 35 percent. AP also reported that the tax would

hit only 3,500 estates in 2011 and generate roughly $11.2 billion in revenue.

From the AP article:

More than 40,000 estates worth $1 million to $10 million

would be expected to escape inheritance taxes next year under the deal struck

by Republicans and President Barack Obama.The package would leave only about 3,500 of the largest

estates subject to federal taxes next year, a boon for the wealthy that many

House Democrats say they can't accept.[...]

The federal estate tax reaches fewer than 1 percent of

inheritances, but it has long been a political lightening rod among lawmakers

from both parties. Many Republicans want to eliminate the estate tax

altogether, derisively calling it a "death tax" that makes it hard

for parents to transfer small businesses to their children.Estate tax opponents got their wish this year, when the tax

was temporarily repealed. But the tax holiday will be short-lived because,

under current law, the estate tax is scheduled to return next year with a top

rate of 55 percent for estates larger than $1 million for individuals and $2

million for married couples.The package Obama negotiated would set the top rate at 35

percent and exempt the first $5 million of an individual's estate. Couples

could exempt $10 million.At those levels, the tax would affect just 0.14 percent of

all estates in 2011, or about 3,500 estates, generating about $11.2 billion in

revenue, according to an analysis by the Tax Policy Center, a Washington research

group.Under the current law, more than 44,000 estates are projected

to be taxed next year based on the number of estate-holders in that value

bracket who are likely to die. That would generate $34.4 billion in taxes.

[Associated Press, 12/8/10, via Huffington Post]

CBO:

"Most Owners Of Family Farms And Small Businesses Are Unlikely To Owe Estate

Tax." From a 2009 Congressional Budget Office (CBO) report that

looked at the effect of the estate tax on small businesses and farms in 2000

and 2005, when the estate tax affected more taxpayers than it does now:

A commonly expressed concern is the effect of the estate tax

on family farms and small businesses, including the possibility that heirs may

be forced to liquidate the business to pay the estate tax. As with the general

public, most owners of family farms and small businesses are unlikely to owe

estate tax. About 2.1 percent of farmers (1,137) and 2.4 percent of

small-business owners (8,291) who died in 2005 had to file estate tax returns.The vast majority of estates, including those of farmers

and small-business owners, had enough liquid assets to pay the estate

taxes they owed in 2005. However, estates involving farms or small businesses

are slightly less likely than other estates to have sufficient liquid assets to

cover their estate taxes. In 2000, when the effective estate tax exemption amount

was $675,000, 138 (or about 8 percent) of the estates of farmers who left

enough assets to owe estate taxes faced a tax payment that exceeded their

liquid assets, compared with about 5 percent of all estates that owed taxes.

Those numbers are upper bounds, however, because the definition of liquid

assets used on estate tax returns excludes some money held in trusts, which

could also be used to pay estate taxes. The increase in the exemption amount

since 2000 probably further mitigated the impact on small businesses. Moreover,

the estate tax currently includes several provisions that owners of family

farms and small businesses can use to mitigate its effect. For example, heirs

are allowed to pay the tax in installments over 15 years at low interest rates,

and several special valuation provisions allow some assets to be assessed at

less than their market value. [Congressional Budget Office report on Federal

Estate and Gift Taxes, 12/18/09]

The

Phrase "Death Tax" Is A Loaded Term Created By GOP Pollster Frank

Luntz To Make The Estate Tax Unpopular. The Washington Post reported

that GOP pollster Frank Luntz (now a Fox News contributor) "poll-tested

the term 'death tax' and advised the new GOP majority to never use the terms

'inheritance' or 'estate tax' again." From the Post:

By 1994, Newt Gingrich's Republican insurgents had latched

onto the estate tax issue, but the Contract With America called for an estate

tax reduction, not repeal. In 1995, Luntz poll-tested the term "death

tax" and advised the new GOP majority to never use the terms

"inheritance" or "estate tax" again.[...]

But ultimately, whether people believe the estate tax will

affect them has little bearing on support for repeal. Early this year, with

[anti-estate tax activist Patricia] Soldano's money, Luntz again began polling,

this time in the face of record budget deficits and lingering economic unease.

More than 80 percent called the taxation of inheritances "extreme."

About 64 percent said they favored "death tax" repeal. Support fell

to a still-strong 56 percent when asked whether they favored repeal, even if it

temporarily boosted the budget deficit. [The Washington Post, 4/13/05]

Two Save The Economy Segments Pushed Right-Wing

Talking Point That Obama Policies Cause "Uncertainty"

Save

The Economy Segment Pushes Theory That Businesses Won't Invest Because Of

"Uncertainty" Caused By Health Care Reform And Financial Regulation. The

June 30 edition of the 10 Ways to Save the Economy special was dedicated to the

"uncertainty" supposedly caused by regulations. From the June 30 edition of Fox

News' Special Report:

BRET BAIER (host): In tonight's segment on saving the

economy: a look at federal regulations and the time it takes to implement them.

Correspondent Shannon Bream reports if there's one certainty, it seems to be

uncertainty.(BEGIN VIDEOTAPE)

VERONIQUE DE RUGY (George Mason University): In the next ten

years, maybe more investors, entrepreneurs, business owners, are going to be in

limbo.SHANNON BREAM (Fox News Correspondent): Each time a federal

law is passed, detailed regulations that outline how that law will be

implemented are issued by the relevant agencies. But that often takes a great

deal of time, especially when it comes to a 2,000 plus page bill like the

president's new health care program or the Dodd-Frank bill passed last year,

described as the biggest overhaul to the American financial regulatory system

in history.In fact, some regulations for the Patriot Act, first passed

in 2001, still aren't finished. Most laws like Dodd-Frank have built in time

frames for getting regulations drafted, subjected to public comment, and then

finalized. But those markers aren't always met.DE RUGY: It's hard to tell, because a lot of these rules were

going to be ruled out one after the other, and there were deadlines for some of

them. And I know we've missed a lot of deadlines on both fronts of rules that

were going to have to be written by a certain deadline. So it's really hard to

tell.BREAM: Meanwhile, businesses are left in a holding pattern,

unsure of how to move forward until they know how they'll be impacted. Dan

Danner of the National Federation of Independent Businesses says small

businesses which operate on very tight margins are especially worried about the

unknown.DAN DANNER (National Federation of Independent Businesses):

They don't know what the cost of their health care is going to be. They just

know they're going to be mandated to provide something. They're going to be

told what that is, and they have no idea what it's going to cost.BREAM: Experts say while most businesses admit they dislike

government regulation, they can deal with the requirements and red tape as long

as they know what they're facing. Danner says when the government issues

regulations in a timely fashion, the small businesses he represents can plan,

invest higher, and do their part to move the U.S. economy forward.DANNER: Small businesses and entrepreneurs are inherently

optimists, and so we look forward to the future, and our small business members

do, and they're looking forward to things getting better and them creating

jobs.(END VIDEOTAPE)

BREAM: As for how the regulations tied to implementing the

president's health care law are progressing,

the initial proposals have been drafted but the final batch of regulations

won't be issued until 2015 -- if they're finished on schedule. [Fox

News, Special Report with Bret Baier, 6/30/11]

June 28 Save The

Economy Segment Also Pushed The "Uncertainty" Talking Point. During the June 28 segment of 10

Ways to Save the Economy Shannon Bream continued to push the idea that a sense

of uncertainty was negatively impacting the economy. Bream said: "[T]he

unresolved debt crisis and how lawmakers will address issues regarding the

solvency of Medicare, Medicaid, and Social Security are fueling a level

of uncertainty that tends to bring small businesses to a standstill."

From Special Report with Bret Baier:

BRET BAIER (host): We learn today that consumer confidence

has hit a seven-month low. In tonight's report on saving the economy, we talk

about the lack of confidence by small business owners. Correspondent Shannon

Bream tells us many people feel that is a major reason for the extended

economic slump.(BEGIN VIDEOTAPE)

DAN DANNER (National Federation of Independent Business): I

mean, traditionally, we are led out of a recession by small businesses hiring

people and creating jobs. And that's not happening in this recession at this

time.SHANNON BREAM (Fox News Correspondent): Dan Danner is

president and CEO of the National Federation of Independent Businesses, a

nonpartisan group that represents small businesses across the U.S. The

organization's latest survey shows those businesses, by all accounts, crucial

to the recovery of the U.S. economy aren't feeling particularly hopeful. May

marks the third consecutive month that small business optimism dropped.Only 5 percent of small business owners say that now is a

good time to expand and data from the Bureau

of Labor statistics shows the 12-month period that ended in March 2010 marked

the lowest number of startup businesses in the U.S. since the bureau started

measuring the trend in the early 90s. So, what's driving the lack of small

business confidence?Experts say Washington's unresolved debt crisis and how

lawmakers will address issues regarding the solvency of Medicare, Medicaid, and

Social Security are fueling a level of uncertainty that tends to bring many

small businesses to a standstill.BRAD JENSEN (Georgetown University): There's enormous

uncertainty about how the political process is going to grapple with those

issues. I think that now that the economy is kind of on its back, the

uncertainty looms much larger.VERONIQUE DE RUGY (George Mason University): It paralyzes

entrepreneurs and people who usually are willing to actually take risk and

invest their own money in their business, but also invest in workers and hire

people.BREAM: And while pundits, lawmakers and economists may

disagree about how to resolve those weighty problems, there is general

agreement that coming to some kind of resolution will allow small businesses,

now waiting on the sidelines, to restart hiring and investing.DE RUGY: So lifting this uncertainty is really key to allow

and empower individuals and entrepreneurs. Because, I mean, ultimately, they

are the true actors of economic recovery.(END VIDEOTAPE)

BREAM: Small business leaders say, somewhat surprisingly

that a lack of access to capital isn't an issue for them right now. They say

that's because until the U.S. economy's long-term future is more certain, most

of them just aren't interested in expansion. [Fox News, Special Report

with Bret Baier, 6/28/11]

Fox

Has Previously Pushed The Conservative Talking Point That Obama's Economic

Policies Hurt The Economy By Leading To "Uncertainty" In The Private Sector. During

the April 3 edition of ABC's This Week, former Bush

administration official Torie Clarke asserted that "What will really get the

private sector humming and hire a lot of people is if they have predictability

and certainty about things like regulatory regimes and are some of these trade

agreements going to go through that we really need." Reps. John Boehner and

Kevin McCarthy also said that "uncertainty" on tax cuts was hindering

job creation during the September 26, 2010, edition of Fox News Sunday.

Several Fox anchors adopted the talking point soon after Boehner's and

McCarthy's comments. [Media Matters, 4/3/11, 9/27/10]

Krugman:

"Uncertainty Is Just A Myth Being Made Up" To Blame Economy On Obama. Responding

to Torie Clarke's comments on This Week, Nobel

Prize winning economist Paul Krugman said: "The reason

businesses are not investing is that they have tons and tons of excess

capacity. There is a very clear relationship historically between the

amount of unemployment and business investment. When unemployment is high, when

capacity is low, investment is low there is nothing -- all of this

stuff about uncertainty is just a myth being made up to blame this on

Obama." [ABC, This Week via Media Matters, 4/3/11]

Fox Concluded Its Series By

Pushing Another Right-Wing Talking Point On Deregulation

Special

Report: Deregulation Can "Save The Economy" Because "America Finds Herself

Increasingly In Competition," With Countries With More Heavily Deregulated

Private Sectors. From Fox News' Special Report with Bret Baier:

BRET BAIER (host): We conclude

our two week series on saving the economy tonight with a big picture look at

just what American business is up against. Chief Washington correspondent James

Rosen tells us it's a tough world out there.JAMES ROSEN (Fox News Correspondent):

Every minute of every day of every year we are locked in mortal struggle, a

fierce battle over the disposition of scarce resources and precious human

capital that pits us against nearly 200 other nations around the world.DAN DANNER (National

Federation of Independent Business): There's no question today that almost

every business is global. The whole question about outsourcing is: Where is the

best business environment?ROSEN: America finds herself

increasingly in competition. Especially with those nations known as the BRIC

countries: Brazil, Russia, India and China. Those last two, India and China,

have over the last five years both ranked among the top 40 most improved

countries in terms of easing the regulatory burden they impose on their own

business classes.MARTIN BAILY (Former White

House Economics Advisor): They embarked on a program of deregulation but they

still have a lot of it left. So I suspect that they will continue to be on a

deregulatory track.ROSEN: In 2010, and for the

fifth consecutive year, the World Bank's annual "Doing Business"

survey, which ranks 183 economies in terms of their regulatory burden, found

Singapore to be the world's friendliest regulatory environment, followed by

Hong Kong, New Zealand, the United Kingdom, and then the United States. This

fifth place ranking represented a decline for the U.S., which placed third in

2009, and saw America bucking a worldwide trend.That trend has seen 85 percent

of the world's economies over the last five years take steps to make it easier

for local entrepreneurs to operate. Last year 61 countries fared better than

the U.S. in terms of the tax burden on business owners.ROSEN: The regulatory burden

that the United States government imposes on its business class -- where do we

fall in ranking of the industrialized states?VERONIQUE DE RUGY (George

Mason University): If you had asked me this ten year ago, I would have told you,

I mean, America is the place to start a business. It's not true anymore today,

and we know that the heavier the regulation, in particular in product and labor

market, the more it reduces economic growth.ROSEN: Of course, some

regulations, like child labor laws, just to name one, remain vital. But

economists from across the spectrum agree that for America to compete in the

global economy, regulations should themselves be tightly regulated, tailored

narrowly to address specific problems and made to go away when those problems

do. [Fox News, Special Report with Bret Baier, 7/1/11]

But Special Report Failed To Note

That Obama "Order[ed] A Government-Wide Review" "To Remove Outdated Regulations

That Stifle Job Creation And Make Our Economy Less Competitive." In a Wall Street Journal op-ed

titled "Toward a 21st-Century Regulatory System," President Obama called for

the United States to "strike the right balance" between regulations

and their costs. He wrote: "Regulations do have costs; often, as a country, we

have to make tough decisions about whether those costs are necessary. But what

is clear is that we can strike the right balance. We can make our economy

stronger and more competitive, while meeting our fundamental responsibilities

to one another." From The Wall Street Journal:

[T]hroughout our history, one

of the reasons the free market has worked is that we have sought the proper

balance. We have preserved freedom of commerce while applying those rules and

regulations necessary to protect the public against threats to our health and

safety and to safeguard people and businesses from abuse.From child labor laws to the

Clean Air Act to our most recent strictures against hidden fees and penalties

by credit card companies, we have, from time to time, embraced common sense

rules of the road that strengthen our country without unduly interfering with

the pursuit of progress and the growth of our economy.Sometimes, those rules have

gotten out of balance, placing unreasonable burdens on business--burdens that

have stifled innovation and have had a chilling effect on growth and jobs. At

other times, we have failed to meet our basic responsibility to protect the

public interest, leading to disastrous consequences. Such was the case in the

run-up to the financial crisis from which we are still recovering. There, a

lack of proper oversight and transparency nearly led to the collapse of the

financial markets and a full-scale Depression.Over the past two years, the

goal of my administration has been to strike the right balance. And today, I am

signing an executive order that makes clear that this is the operating

principle of our government.This order requires that

federal agencies ensure that regulations protect our safety, health and

environment while promoting economic growth. And it orders a government-wide

review of the rules already on the books to remove outdated regulations that

stifle job creation and make our economy less competitive. It's a review that

will help bring order to regulations that have become a patchwork of

overlapping rules, the result of tinkering by administrations and legislators

of both parties and the influence of special interests in Washington over

decades.Where necessary, we won't shy

away from addressing obvious gaps: new safety rules for infant formula;

procedures to stop preventable infections in hospitals; efforts to target

chronic violators of workplace safety laws. But we are also making it our

mission to root out regulations that conflict, that are not worth the cost, or

that are just plain dumb.For instance, the FDA has long

considered saccharin, the artificial sweetener, safe for people to consume. Yet

for years, the EPA made companies treat saccharin like other dangerous

chemicals. Well, if it goes in your coffee, it is not hazardous waste. The EPA

wisely eliminated this rule last month.But creating a 21st-century

regulatory system is about more than which rules to add and which rules to

subtract. As the executive order I am signing makes clear, we are seeking more

affordable, less intrusive means to achieve the same ends--giving careful

consideration to benefits and costs. This means writing rules with more input

from experts, businesses and ordinary citizens. It means using disclosure as a

tool to inform consumers of their choices, rather than restricting those

choices. And it means making sure the government does more of its work online,

just like companies are doing.We're also getting rid of

absurd and unnecessary paperwork requirements that waste time and money. We're

looking at the system as a whole to make sure we avoid excessive, inconsistent

and redundant regulation. And finally, today I am directing federal agencies to

do more to account for--and reduce--the burdens regulations may place on small

businesses. Small firms drive growth and create most new jobs in this country.

We need to make sure nothing stands in their way.[...]

Despite a lot of heated

rhetoric, our efforts over the past two years to modernize our regulations have

led to smarter--and in some cases tougher--rules to protect our health, safety

and environment. Yet according to current estimates of their economic impact,

the benefits of these regulations exceed their costs by billions of dollars.This is the lesson of our

history: Our economy is not a zero-sum game. Regulations do have costs; often,

as a country, we have to make tough decisions about whether those costs are

necessary. But what is clear is that we can strike the right balance. We can make

our economy stronger and more competitive, while meeting our fundamental

responsibilities to one another. [Wall Street Journal, 1/18/11]

Fox

Has Repeatedly Pushed Deregulation Talking Point. Fox News shows and

others in the conservative media have repeatedly pushed for more deregulation.

Indeed, conservative media figures even used the one-year anniversary of the

Gulf of Mexico oil spill to push for deregulation of the drilling

industry. [Media Matters, 6/23/11, 6/7/11, 6/2/11, 4/20/11, 4/20/11, 2/10/11]

Only Three Of The Ten Save The Economy Segments Did

Not Clearly Push Right-Wing Talking Points

June

20: Ten Ways To Save The Economy Segment Focuses On The Importance Of

Raising Consumer Confidence. From the June 20 edition of Fox

News' Special Report:

SHANNON BREAM (guest host): Tonight, we begin a ten-part

series looking at possible ways to fix the struggling economy. First up, Chief

Washington correspondent, James Rosen, on consumer confidence.(BEGIN VIDEOTAPE)

JAMES ROSEN (Fox News Correspondent): Y2K, the dawn of a new

millennium, and also, according to the data kept by the conference board, the

peak of American consumer confidence with the 144.7 posted in January 2000, the

highest measurement ever of this crucial statistic since economists first

developed it back in 1967.MARTIN BAILY (Former White House Economic Advisor): So, they

ask consumers various questions about how they stand right now, how they think

the economy is going in the future. Everybody is kind of gloomy about the

future. People don't spend, they don't invest, they don't take risks, then the

economy is likely to remain on a slow growth or even on recession path.ROSEN: Gallup surveys this month found consumer confidence hitting

a new low for the year, a reflection analyst said of dismal job growth and Wall

Street decline. President Obama cited still another factor, high gasoline

prices.BARACK OBAMA (President, United States): It has enormous